The last few years have seen a wave of anti-trans Republican legislation introduced across the country, and much of it has become law. To name just a few examples: In 2016, North Carolina and South Dakota banned transgender kids from using public bathrooms that correspond with their gender identity. Over two years ago, Idaho banned transgender women students from competing on sports teams that align with their gender identity. And last year, Alabama became the second state to ban gender-affirming care for minors and the first to criminalize doctors who provide it, threatening them with up to 10 years in prison.

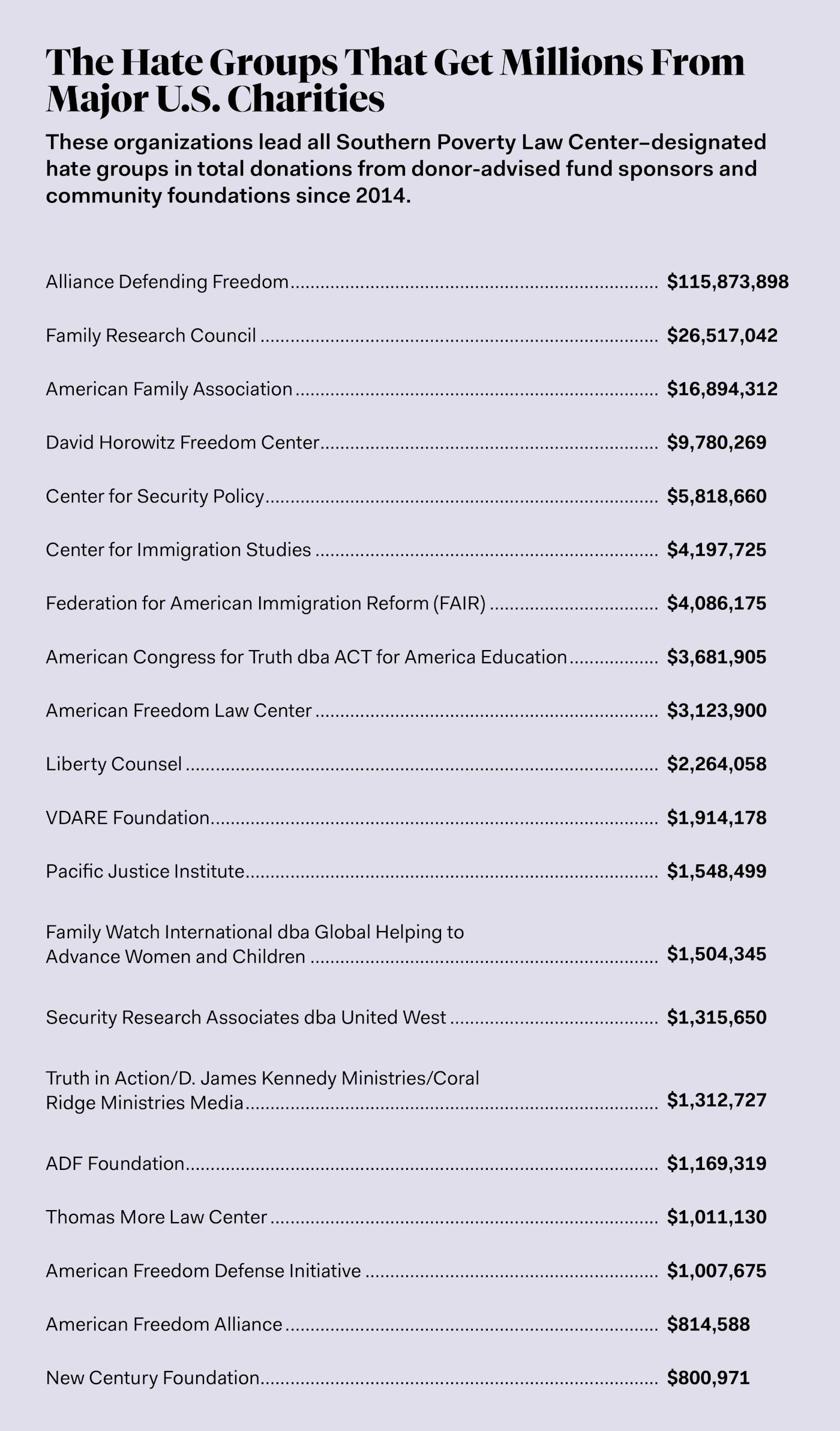

The same organization was behind these laws: Alliance Defending Freedom, a Christian legal powerhouse that drafts, lobbies for, and defends anti-LGBTQ legislation and policies. This year alone, 500 bills have already been introduced around the country. And ADF’s power is only growing: The nonprofit organization’s annual gross receipts doubled from $52 million in the 2016 fiscal year to $104 million in fiscal year 2022.

It’s perhaps not surprising, given the rise of anti-LGBTQ rhetoric on the right in recent years, that ADF’s hateful agenda would be so well funded. But research by The New Republic and the OptOut Media Foundation has found that much of the organization’s money actually comes from charities tied to America’s largest investment firms, including Fidelity, Vanguard, and Schwab. Other notorious anti-LGBTQ organizations, such as the Family Research Council, as well as groups espousing anti-immigrant, anti-Muslim, and white nationalist ideology, also get much of their funding from these major mainstream charities.

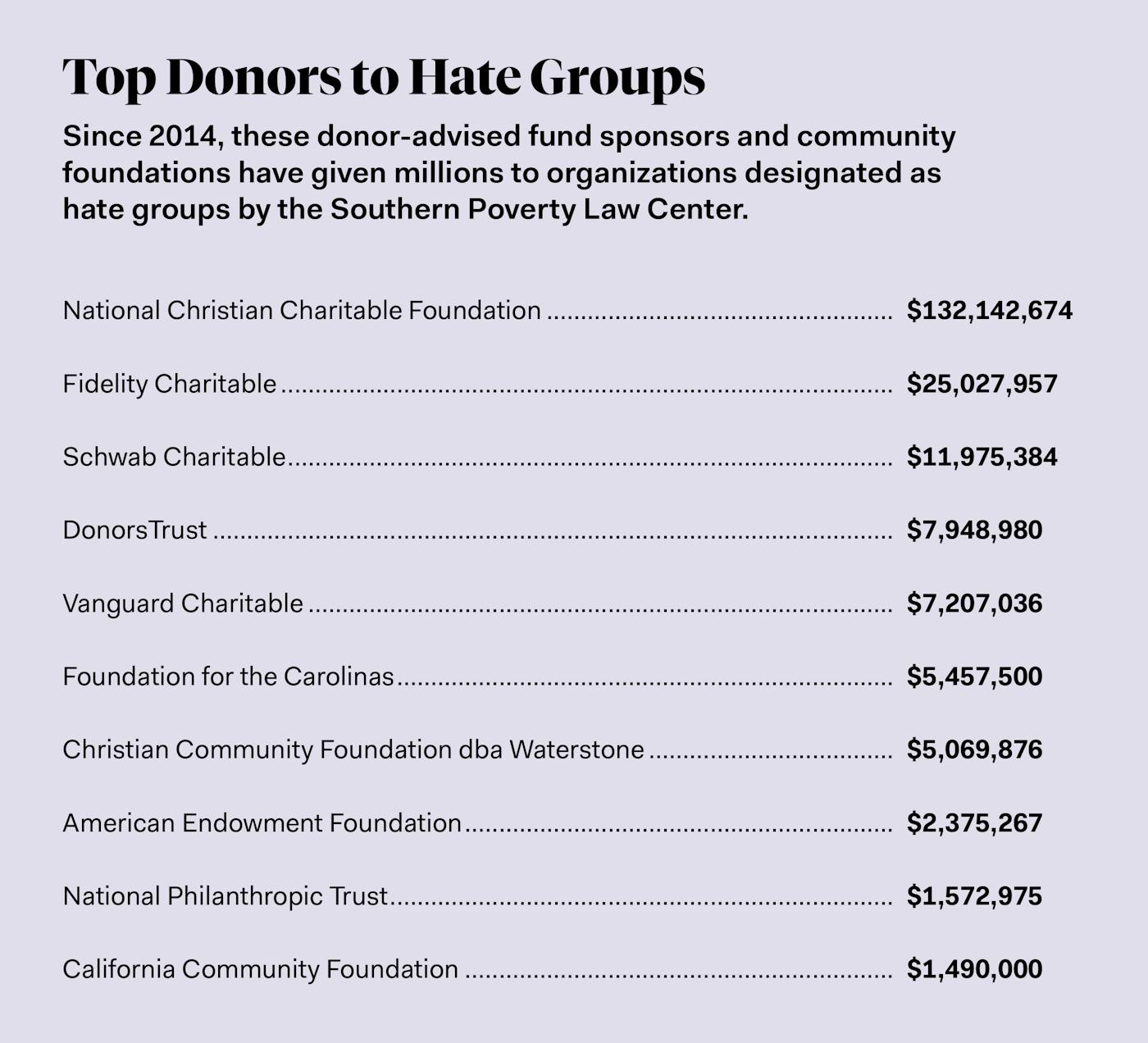

Over the last decade, dozens of organizations designated as hate groups by the Southern Poverty Law Center have received more than $200 million from these types of charity funds, as well as from community foundations. What’s more, these funds allow Americans to donate to bigoted organizations without revealing their identity—while also getting a tax break for it.

Each year, some 140 million American adults give around $500 billion to charities, donations they can then deduct from their taxes. And one way of giving has become increasingly popular with wealthy Americans: donor-advised funds, which are charitable accounts managed by third parties.

When someone deposits money into a donor-advised fund, they immediately earn a charitable tax deduction; plus, they can transfer appreciable assets such as stock into the account without having to pay the capital gains tax that would normally accompany the sale of one’s earnings. For a fee, financial professionals reinvest the money to make it grow. Whenever clients feel like it—as in, many years later, if ever—they can “advise” the fund manager on how much and to which organizations their donations should go. The fund manager almost always obliges.

“DAFs are popular and fast-growing because of the tax benefits and the convenience,” Roger Colinvaux, a law professor at the Catholic University of America, told me. “Donors get the best tax benefits available, without having to fully give up control of their funds.”

But here’s the catch: When someone puts money or assets into a donor-advised fund, it’s no longer their money. They get the charitable tax deduction, since they’re actually donating to the donor-advised fund sponsor, a 501(c)(3) charity that then legally owns the money and has full discretion over where it goes. That also allows the donors to remain anonymous, both to the public and even to the IRS. So if someone wanted to fund, say, a white nationalist hate group but didn’t want the media or the government to catch wind of it, they’d use a donor-advised fund.

That’s exactly what many Americans are doing.

Fidelity Charitable is the biggest public or private charity in the nation by donations received, having taken in over $15 billion in contributions in the 2021–22 fiscal year. (While the organization is incorporated separately from Fidelity Investments—the former is a 501(c)(3) nonprofit, the latter a private for-profit—it employs Fidelity Investments to manage its clients’ money, handing over some of the clients’ fees in exchange.) Over the last eight fiscal years, Fidelity Charitable doled out more than $25 million to Southern Poverty Law Center–designated hate groups. ADF got the most, at $8.7 million, and among the other anti-LGBTQ recipients, the Family Research Council ($1.9 million), Family Watch International ($1.1 million), and the American Family Association ($800,000) topped the list.

Like ADF, the Family Research Council has attempted to link homosexuality and pedophilia. “While activists like to claim that pedophilia is a completely distinct orientation from homosexuality, evidence shows a disproportionate overlap between the two,” wrote Family Research Council president Tony Perkins on his group’s website in 2010. “It is a homosexual problem.” Family Watch International, which promotes anti-LGBTQ policies around the world, also links gay men and pedophilia. The American Family Association, which advocates for “traditional moral values” in media, has called homosexuality “a poor and dangerous choice” and claims it’s a threat to public health.

The biggest known funder of SPLC-designated hate groups in the United States by far is the National Christian Charitable Foundation, an ideological donor-advised fund sponsor that pulled in over $3 billion in contributions in 2021. It has funneled over $130 million into anti-LGBTQ hate groups from 2014 to 2021, including: $93 million to ADF, $20 million to the Family Research Council, $14.6 million to the American Family Association, and $1.2 million to Liberty Counsel.

It’s not just anti-LGBTQ groups that are receiving windfalls from these funds. We tracked over 1,100 contributions from 91 donor-advised fund sponsors and community foundations (which operate the same way as donor-advised funds) to 60 organizations designated as hate groups by the Southern Poverty Law Center, amounting to nearly $210 million since 2014. (These don’t include many donations from 2022 and 2023, since most of those tax records are not yet available.) In addition to Fidelity Charitable, several other donor-advised fund sponsors linked to reputable investment firms are high on the list: Schwab Charitable, at third, has given $12 million to hate groups since 2014, and Vanguard Charitable, at fifth, has given $7.2 million.

While much of this money is funding anti-LGBTQ organizations, it’s also going to other hate groups.

Fidelity Charitable has committed $240,000 to white nationalist hate groups since its 2015 fiscal year, most of it going to the VDARE Foundation and the New Century Foundation, which publishes American Renaissance. These two notorious organizations are known for spreading racist myths, and both have been cited in white nationalist mass shooters’ manifestos or social media posts. Fidelity Charitable also has donated $9 million to anti-Muslim groups, including $4 million to the David Horowitz Freedom Center and $2.2 million to the American Freedom Law Center. Vanguard Charitable, meanwhile, has donated millions to anti-immigrant outfits, such as the Center for Immigration Studies and Federation for American Immigration Reform, since fiscal year 2014. Both groups fearmonger about immigrants in an effort to restrict immigration to the U.S., and they are influential in conservative politics, the former having been closely tied to Stephen Miller and the Trump White House, and the latter frequently sending its representatives to lobby and testify before Congress.

None of the donor-advised fund sponsors named in this story replied to requests for comment.

Major donor-advised fund sponsors rarely change their giving policies, likely fearful of lawsuits from angry clients. But smaller foundations do sometimes bow to pressure. The Inland Northwest Community Foundation, a charity that rebranded as the Innovia Foundation, resisted calls to stop funding the VDARE Foundation for years. But in 2020, after the Southern Poverty Law Center and the Council on American-Islamic Relations published a report that included Innovia’s financing of VDARE, the foundation came out with an anti-hate policy and cut off hate groups.

As Innovia’s ex-CEO Mark Hurtubise wrote in Sludge, the Council on Foundations, the accrediting body for community foundations, could incorporate a serious diversity, equity, and inclusion policy into its national standards. And during the last session of Congress, when Democrats controlled both houses and the White House, lawmakers could have held hearings on how the IRS grants tax-exempt status to hate groups and on its lax oversight of donor-advised fund sponsors. With the House now in the hands of Republicans, who often collaborate with some of the hate groups funded by donor-advised fund managers and recently succeeded in cutting funding to the IRS, this is extremely unlikely.

This piece was written in partnership with the OptOut Media Foundation.