Over the past few months, as the orderly operations of the world economy have been superseded by panic, fear, and lockdown, as the circuit breaker has paused trading on Wall Street more than once, and as oil prices flipped to negative, editorial pages across the country have revived the ideas of John Maynard Keynes. Should the government spend to counter the possibility of recession or worse? And if so, how much and through what particular mechanism: tax cuts, subsidies, direct federal spending, grants to cities and states? Even Keynes, who argued that it was folly for economists (or anyone else) to forecast the future, might have taken pleasure in just how predictable it is that when a disaster unfolds, his name is invoked. There are few market purists who can resist Keynes in a crisis.

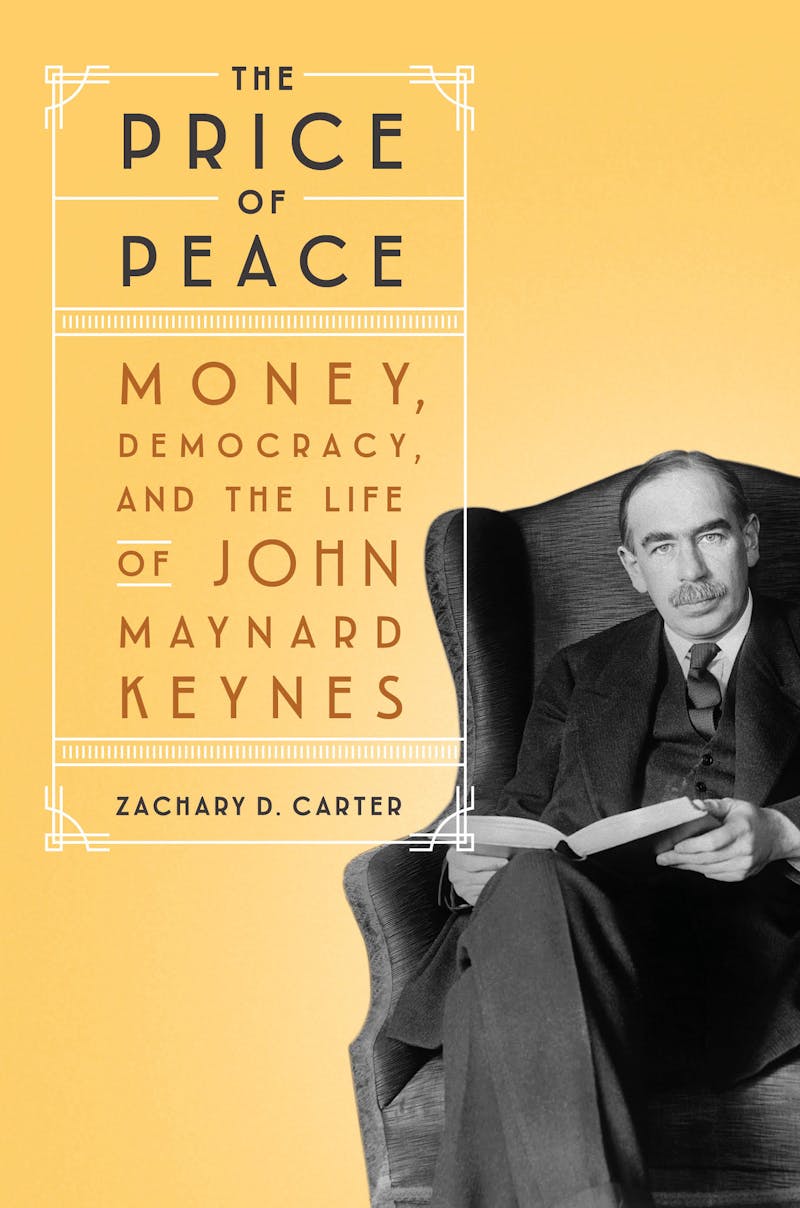

But what Keynes would have made of the use of his thought is another question altogether. As Zachary D. Carter’s new biography, The Price of Peace: Money, Democracy, and the Life of John Maynard Keynes, makes abundantly clear, Keynes was a stranger and more challenging economic thinker than we generally take him to be. Debates about stimulus and spending are only the beginning of his thought, which ranged over ethics and politics as well as economics, and which was far more heterodox than the interpretations of his work that have come down to us today would suggest. Our own moment, in which an apparently prosperous society has been undone in a matter of weeks, would have been all too familiar to Keynes, whose adult life was bookended by the two world wars and punctuated by the Great Depression.

Inspired by this climate of disaster, Keynes came to embrace a very radical set of faiths about capitalism. He suggested that investment decisions might be too crucial to be left to the whims of finicky entrepreneurs. He argued that the willingness of people to consume was the key determinant of social wealth. He made the case that markets were never self-correcting, autonomous realms, that their smooth operation could not be taken for granted, and that the state should not be reluctant to intervene in brash and imaginative ways to secure the social good. And as Carter suggests, he was deeply skeptical of the wisdom of frugality and the prudence of saving for the future—an attitude that grew in large part out of his lifelong association with the countercultural and modernist intellectuals of the Bloomsbury Group.

The distillation today of Keynes’s legacy into a Hail Mary of stimulus spending on airlines or highways or McDonald’s franchises (“small business”) might mark in its own way a quiet tragedy—one of misapprehension and missed chances. It may also tell us something about Keynes. In the last paragraph of his most influential book, The General Theory of Employment, Interest and Money, Keynes famously insisted that “it is ideas, not vested interests, which are dangerous for good or evil,” and that “the world is ruled by little else.” But the way ideas are taken up or not is always shaped by material circumstances, and, oddly enough, the history of Keynes and his thought—for all its brilliance and idiosyncrasy—points ultimately to the limits of ideas alone in remaking the world.

Keynes was born in 1883, near the high point of the British Empire. His father was an economist, and his mother an active social reformer. He was an extraordinary student from an early age, but also suffered from various health problems that at times meant prolonged absences from school—a frailty that might have given him an intuitive sense of the limits of individual agency.

Keynes attended Cambridge University on scholarship, though he never studied economics there, instead focusing on mathematics. He fell in early with a secretive intellectual society known as the Apostles, and became devoted in particular to the work of philosopher G.E. Moore, who argued that what mattered most in life was inculcating in oneself a “state of consciousness” that would be open to “the good”—with goodness being understood as intrinsic to art, literature, music, something “simple, undefinable, unanalyzable.” This was the opposite of utilitarianism, or the suggestion that what was good was that which would benefit the greatest number of people. Moore’s philosophical approach had a distinctly noncommercial quality to it: It argued for the primacy of aesthetics and ethics over the ordinary business of life.

The Apostles was also a society of men, and the young Keynes was condescending to women at best. “I seem to hate every movement of their minds,” he once wrote to a friend about women students at Cambridge. Carter emphasizes that Keynes as a young man was exclusively gay, and during his early twenties he pursued what appear to have been dozens of romantic relationships and sexual encounters with men. (He cites Keynes’s tallying of these on note cards bearing titles such as “The Young American Near the British Museum.”) British society in the early twentieth century was hostile to homosexuality, but the Apostles provided a space that embraced and honored these connections—even as it did so in secret, for Keynes would never have wanted his sexuality to be known by employers or others. At the same time, Keynes’s sexual rebelliousness, as with his embrace of Moore’s thought, mirrored his rejection of the conventional faith of the business classes of his day. “Free trade and free thought! Down with pontiffs and tariffs,” he proclaimed in December 1903.

When he left Cambridge, it was to move to London along with a group of friends, many connected with the Apostles, mostly artists and writers, including Lytton Strachey, E.M. Forster, Leonard Woolf, Virginia Woolf, and her brother Adrian Stephen. The intellectual community became known as Bloomsbury after the London square where many of its members lived, and it was as devoted as the Apostles once had been to art, literature, and aesthetic experience as the highest goal of life. Keynes was in some ways an odd fit for the “Bloomsberries,” as Virginia Woolf called them. While his closest friends were writing experimental fiction and painting, he was ascending the ranks of the British government—working for the India Office (though he never visited the subcontinent), the Treasury, and then, once Britain entered World War I, taking responsibility for war finance. He was quickly becoming a star in these official circles. Yet he applied for conscientious objector status during the war, using a framework that Bloomsbury would have recognized: “I have a conscientious objection to surrendering my liberty of judgment on so vital a question as undertaking military service.”

Throughout his life, Keynes lived in these two worlds at once: He was committed to the vision of the good life he had developed as a young man and to the spirit of social, intellectual, and sexual experimentation of the Apostles and Bloomsbury, even as he ascended to a position of high political prominence. Ultimately, he would use his own personal financial success to bankroll The Nation and Athenaeum, a literary journal where his Bloomsbury friends could publish their work. Although he was thoroughly embedded within British political institutions, in his private life he embraced an aristocratic philosophy of desire and artistic creation—and this quiet rejection of outward respectability would come to characterize his economics as well.

Keynes rocketed to public prominence with the publication in 1919 of his devastating account of the negotiations for the Treaty of Versailles, The Economic Consequences of the Peace. The book assailed Woodrow Wilson in particular for assenting to saddle Germany with disastrous war debts, which he predicted would sink Europe into another war. Economic Consequences became a bestseller; it also made it hard for Keynes to get another job at the Treasury, since no one wanted to hire someone willing to paint such biting portraits of the politicians he worked with.

Instead, Keynes went back to Cambridge. He was teaching there in the 1930s as the world sank into depression—an economic collapse so profound that it unsettled all the common faiths of nineteenth-century laissez-faire. At Cambridge, Keynes helped to found what Carter presents as another unconventional community centered on heterodox economic ideas and romantic entanglements. This was a group of younger economists, including Joan Robinson, who, Carter suggests, helped formulate the ideas that would go into The General Theory, which would appear in 1936. Keynes was by this time married to Lydia Lopokova, a Russian ballerina, but he was no less drawn to friends who sought to challenge bourgeois norms. As always, the vantage point he spoke from was more aristocratic than revolutionary, and he had little use for labor. He told a socialist journalist, “when it comes to politics, I hate trade unions.”

But his lifelong sense of distance from conventional morality meant that he was open to anything when disaster arrived in the form of the Great Depression. The only reason not to be—in his opinion—was a fussy, prim commitment to ideas that society had outgrown. “There is no reason why we should not feel ourselves free to be bold, to be open, to experiment, to take action, to try the possibilities of things,” he wrote in one of his early arguments for a massive expansion of public employment. “Over against us, standing in the path, there is nothing but a few old gentlemen tightly buttoned-up in their frock coats, who only need to be treated with a little friendly disrespect and bowled over like ninepins.”

In October 1930, a year after the stock market crash that marked the onset of the Great Depression, Keynes published an essay that might have seemed in almost every way out of step with the events developing around him. Despite the apparent economic gloom, the essay, titled “Economic Possibilities for Our Grandchildren,” suggested that modern society was in fact on the edge of an era of unprecedented growth—that technological advances on the horizon would bring about the end of scarcity. In the past, people had had to struggle to obtain food, shelter, clothing; in the future, abundance would be the norm, and people would be faced with a different dilemma: how to live a good life once they were no longer able to justify their choices in terms of the need to make money.

This promise of imminent affluence—totally at odds with the present reality of skyrocketing unemployment—was not the only surprising aspect of the essay. In the depths of the Depression, as uncertainty and anxiety swirled all around, people might think that the only reasonable course of action was to secure away their savings and hope to ride out the storm. But for Keynes, this attitude simply reflected smug moralism. To save was to be virtuous, to sacrifice pleasure in the present in order to provide for the future—but what it meant in a depression was that the productive resources of society would go to waste, that the dreamed-of general prosperity would never arrive. “The ‘purposive’ man is always trying to secure a spurious and delusive immortality for his acts by pushing his interest in them forward into time,” Keynes wrote. “For him jam is not jam unless it is a case of jam tomorrow and never jam today.”

For Keynes, this simply reflected an antiquated morality. Once people had become accustomed to a life of abundance, they would need to answer the question of how to live well—a problem most had never had to face. But in the future that Keynes imagined, the “love of money as a possession”—rather than simply as a means to an end—would be seen for what it really was, “a somewhat disgusting morbidity, one of those semi-criminal, semi-pathological propensities which one hands over with a shudder to the specialists in mental disease.” Saving the jam for some distant, far-off afternoon, boiling pot after pot of it and never savoring a sweet taste, would be revealed as irrational compulsion.

These attitudes toward saving and demand would help to inspire Keynes’s work throughout the 1930s, as he developed the key ideas in The General Theory—which Carter describes as at once “a masterpiece of social and political thought” and “nearly incomprehensible,” perhaps “the worst-written book of its significance ever published in the English language.” At its heart was Keynes’s argument that markets were not self-correcting, because economic activity depended on the decisions of investors—people who were motivated by “animal spirits” and by emotional impulses as much as by any clear-eyed assessment of economic reality. This is not their fault. No one knows the future, and everyone is simply trying to guess. The stock exchange hardly represented some kind of collective wisdom. As Keynes put it,

the social object of skilled investment should be to defeat the dark forces of time and ignorance which envelop our future. The actual, private object of the most skilled investment today is to “beat the gun,” as the Americans so well express it, to outwit the crowd, and to pass the bad, or depreciating, half-crown to the other fellow.

Conventional theory suggested that if only wages fell far enough, employers would start to hire; if only prices slipped down enough, people would consume; if only interest rates sank low enough, it would become profitable for investors to borrow and begin to build new factories. But the Great Depression and its attendant deflation indicated that this point might never come. Left to itself, the market might arrive at equilibrium and leave a third of the population unemployed.

To counter this, Keynes suggested, the state had to take a far more central role in helping to sustain demand. This would mean spending money on big programs that created jobs, putting money in the pockets of workers who could again go out and buy things. Only in these economic conditions would private investors again find it reasonable to spend. The particular things on which governments spent money could be things that were actually needed by society—affordable homes, new parks, or health clinics (or, one imagines today, N-95 masks, Covid-19 tests, and contact tracers). But even if the state spending went to trivial ends—Keynes famously suggested burying bottles filled with banknotes and allowing “private enterprise on well-tried principles of laissez-faire” to dig the bottles up—that would still be “better than nothing.”

A common faith of nineteenth-century economic thought was that those at the top of the social pyramid deserved to be there because they were uniquely suited to manage economic life. Saving was supposed to create investment for the future. Part of the radicalism of The General Theory lay in its suggestion that public officials and their economists—rather than entrepreneurs and individual profit-maximizing investors—might be the ones most able to safeguard productive investment and thus social prosperity. If there was no automatic relationship between saving and investment—if savings could remain static, never going to employ people or produce goods—then there was little social reason to allow people to accumulate them. This argument, Keynes insisted, demolished “one of the chief social justifications of great inequality of wealth.” He looked ahead to “the euthanasia of the rentier”—the end of a class of people who made their money from lending money to others.

Keynes’s ideas caught fire. They provided an intellectual justification for national governments to take action to combat the high unemployment that was causing political turmoil around the world, a way to explain and rationalize the public works that the Roosevelt administration had pursued well before the publication of The General Theory. The economic recovery that came with World War II seemed to demonstrate in real time that an economy that had appeared frozen could restart if only the state plowed enough dollars into it. Keynes worked for the British Treasury during the war, helping to negotiate the Lend-Lease agreement that enabled the United States to transfer military equipment to the Allied powers even before its entrance into the conflict. He supported the expansion of the British welfare state, the creation of the National Health Service, and the investment of public money in the arts, so that everyone could enjoy the symphonies, operas, and theater that had once been the province only of a few.

And at the end of the war, Keynes traveled to the United States to participate in the Bretton Woods conference that would establish the International Monetary Fund and the World Bank (although his proposed versions of these were less restrictive than those that prevailed). At the ratification of Bretton Woods, he told the audience of diplomats that he hoped the new institutions would be guided as though by good fairies to practice “the virtues of Universalism, courage and wisdom.” On the train back to Washington after the conference, he collapsed, and although he was able to return to England, he died shortly afterward, on Easter Sunday 1946. He would have had every reason to think his vision had triumphed.

The second half of Carter’s book tracks the struggles within the economics profession and in the policy world over Keynes’s thought. The left-leaning Keynesians—most centrally John Kenneth Galbraith, but also Joan Robinson, leader of what became known as “post-Keynesian economics”—wanted to preserve the aspects of his thought that challenged capitalist ideals and norms. They squared off against the more mainstream Keynesians, especially the unassuming Paul Samuelson, who turned Keynes’s social critique and arguments for socialized investment into a much more restricted set of policy suggestions, such as using tax cuts and lowering interest rates. Democratic governments in the United States throughout the postwar years would spend on big programs, but the things they chose to invest in were military armaments, highways, and the privatized mass consumption of suburbia—a conservative, commercial Keynesianism that flouted Keynes’s high hopes for the social values that public investment might affirm. Just as Marx supposedly said that he was not a Marxist, one can easily imagine that Keynes would have distanced himself from the tradition that bears his name.

The Price of Peace manages to convey the fun of reading Keynes, even as it obeys the conventions of popular narrative history with its breezy manner and its insistence on pausing for brief character portraits. But it does suffer somewhat from an adulatory tone toward its subject (admittedly, this might be a hazard of writing about Keynes; once he leaves the scene, the second half of the book is much less fun). Carter approvingly quotes the economist Lionel Robbins reminiscing about Keynes following the conference at Bretton Woods, describing “the God-like visitor” as possessing “a unique unearthly quality of which one can only say that it is pure genius.”

A more skeptical attitude might have permitted Carter to ask whether Keynes himself bears some responsibility for the way that his ideas never quite fulfilled their promise. Keynes’s economic imagination was constrained by a political conservatism. (Carter acknowledges Keynes’s antisemitism, as well as his snobbish disdain for working-class people.) And his deep reluctance to recognize the profound political challenge that his thought posed to the status quo may ultimately have limited the extent to which it could be put into practice. Low unemployment meant more labor market power for workers—a tension Keynes hardly acknowledged. The rentiers were not so likely to quietly agree to their own euthanasia, even if they would temporarily acquiesce to a little extra government spending. Keynes had little interest in the political alliances that could have made some deeper shift possible.

Carter’s book does help us to understand why so many American businesspeople reacted with antipathy toward an economic program that many credited with rescuing capitalism. Perhaps it did so, but it contained elements of an approach to economic life that were sharply at odds with their interests: its emphasis on consumer demand and working-class purchasing power as the key motors of economic growth, its support for policies that might lower unemployment and empower labor, and its general sense that economic life was too much a matter of public concern to be left to the whims of private executives. These were all reasons for businesspeople to view the rise of Keynesian economics departments in the 1940s and 1950s with such alarm, rallying the call of anti-communism to protest against economists who had no such sense of their own radicalism.

As we look at our economic landscape today, not only some policies that come from Keynes but also his broader willingness to flout the conventional economic wisdom may well be of great use. For Keynes, this sensibility came in part from his profound self-assurance and his rejection of traditional mores. But it also grew out of his acknowledgment of the limits of human foresight, his sense that knowing the past might not be any certain guide to the future—that the unexpected is sure to arrive.

What he meant by uncertainty was different, he wrote in one 1937 piece, from the probabilities in a game of roulette. One might not know if the arrow would land on black or red, but it would always fall on one of the two. This was different from historical uncertainty: the prospect of a European war, or “the price of copper and the rate of interest twenty years hence,” or the “position of private wealth owners in the social system in 1970.” In any situation that actually mattered, in other words, the “pretty, polite techniques” of economics, which were “made for a well-panelled board room and a nicely regulated market,” would be utterly useless in determining what to do. In a crisis, “the practice of calmness and immobility, of certainty and security, suddenly breaks down. New fears and hopes will, without warning, take charge of human conduct.” This was why it was necessary to safeguard for the future through public investment rather than private financial calculation. No amount of individual saving would be able to purchase security in a general depression.

In a world that can be upended overnight, a political commitment to shape a humane future becomes all the more essential. Keynes envisioned a society that made possible the goals of increased leisure, more holidays, and the space to pursue happiness, pleasure, self-knowledge, and friendship—all the things that truly matter in life. That underlying vision is worth recovering today, as we find ourselves once again at a precipice, a turning point.