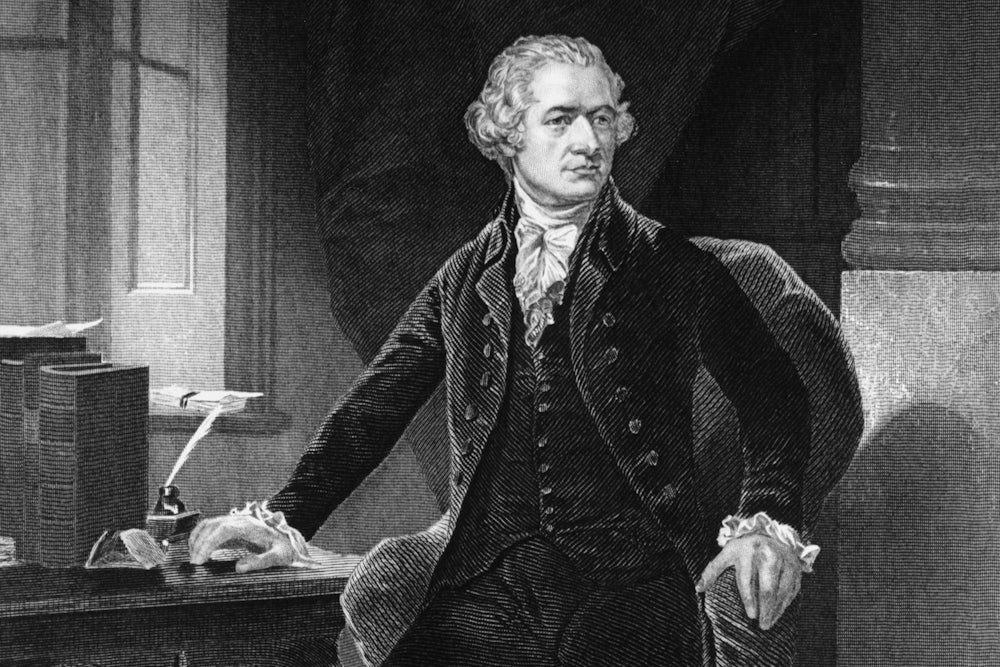

Stephen S. Cohen and J. Bradford DeLong, two key thinkers behind the development of the Green New Deal, have called Alexander Hamilton the “founding father of the American economy.” In their book Concrete Economics, they revisit Hamilton’s pivotal role in creating a modern commercial political economy in the United States. Other Founding Fathers, notably Thomas Jefferson, aspired to maintain a predominately agricultural economy as the only basis for promoting the twin republican virtues of self-sufficiency and community-mindedness. But Hamilton saw a commercial, industrialized economy as the path to American greatness. Jefferson, and later Andrew Jackson, opposed both his goals and his strategies for attaining them.

But Hamilton’s strategy to expand the American economy was remarkably successful. One striking instance of this success was the innovative work that went on at the Springfield Armory, in western Massachusetts. Established in 1777 as the main supplier of weaponry for the Continental Army, the armory evolved into the principal locus of mechanical innovation in the United States. It helped introduce standardized, interchangeable parts and assembly-line production—key ingredients in the takeoff of the Industrial Revolution. Without the initial impetus provided by Hamilton, none of these advances would have come to pass, Cohen and DeLong maintain. “A Jefferson-Jackson United States,” they write, “would have been rural, Anglo-Saxon, Southern and Border-Southern, and not a technological leader but rather a technological follower.” The key difference here was government intervention in the economy: Hamilton’s debt-financed creation of a national market economy brought the American republic into eventual industrial supremacy, via measures such as the federal government’s financial backing for the railroads, whose voracious appetite for iron and steel helped spark America’s Industrial Revolution.

In her book The Entrepreneurial State, Mariana Mazzucato, another economic adviser who has reportedly been influential in sketching out the Green New Deal, comes at the Hamiltonian legacy from the perspective of economic theory. Adam Smith adumbrated the basic workings of a market economy, she observes—but erroneously took it for granted that such a market was inherently self-regulating. Karl Polanyi demolished that notion, demonstrating that the state played the lead role in creating national markets, and has been deeply involved in regulating them ever since. John Maynard Keynes detailed how capitalist economies, far from tending to equilibrium, are prone to extreme volatility due to cycles of over- and underinvestment. Keynes contended that underinvestment could be remedied with the stimulus of government spending, and experience has largely borne out his argument. For Mazzucato, however, Keynes is not the final word on economic policy: That laurel belongs to Joseph Schumpeter, who argued that to achieve real economic development, government spending has to be specifically targeted, at “R&D, infrastructure, labor skills, and direct and indirect support for specific technologies and companies.”

The former Department of War, rechristened the Department of Defense, played just this Schumpeterian role for the American economy in the second half of the twentieth century. Perhaps the most consequential postwar Pentagon initiative for our own digital economy was the Defense Advanced Research Projects Agency (DARPA), founded in 1958 after the launch of the Soviet satellite Sputnik. DARPA fostered a decentralized, networked system that brought the operations of large companies into experimental alliance with innovative startup firms in various technology fields. The agency’s lead programs founded critical research facilities in both private universities and government labs.

DARPA was especially invested in the development of computer science, which led directly to the creation of the personal computer, introduced by Apple in 1976. Thirty-one years later, Apple took to market the revolutionary iPhone and iPod Touch, followed by the iPad. Many of the technologies underlying these devices came from entities underwritten by DARPA, and Apple itself received significant government financial assistance all along the way; none of this technology would have had any outlet without the internet, another DARPA-generated invention.

Nevertheless, Apple’s incalculable debt to the U.S. government has not deterred it from employing virtually every subterfuge at its disposal to duck applicable tax levies. Mazzucato argues that Apple is essentially cheating its investors out of their fair share of its profits—the investors in this case being U.S. citizens whose tax payments funded its commercial rise. Mazzucato proposes that in such cases the government should be entitled to a hefty share of preferred stock. This would allow it to redeem the higher dividends granted to preferred shareholders. (And in recompense for such returns, preferred shares, unlike common ones, confer no ownership of the company, thus negating the hoary issue of socialism.)

Mazzucato’s analysis suggests how a Green New Deal could be financed, and over time become self-financing, a status that DARPA, too, might have achieved had it held a significant block of preferred stock in just one company, Apple. “The Internet affected the course of world history,” she writes. And as she well knows, human survival requires that course to be changed again.