By now, it’s no secret that the sweeping tax reform package approved by Congress last week includes a bunch of provisions that help the oil and gas industry. As the Washington Post reported, cutting the corporate income tax rate alone will likely add $1 billion to the profits of U.S. oil and gas exploration and production firms. Oil refining companies stand to do even better, according to one analyst who estimated that those companies’ earnings per share will increase by an average of 23 percent. The tax bill also opens up the Arctic National Wildlife Refuge in Alaska, the largest wildlife refuge in America, to drilling.

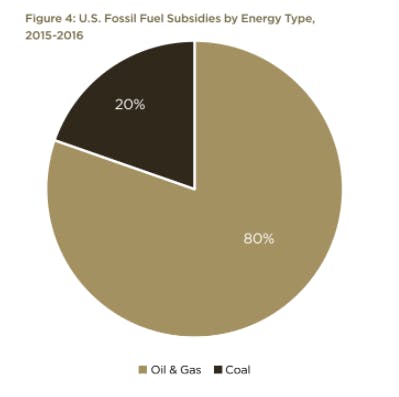

But there’s also something to be said about what the tax bill didn’t change: the billions of dollars in permanent, century-old tax subsidies for the fossil fuel industry. According to Oil Change International, the U.S. federal government provides a combined $14.7 billion in various annual subsidies for the fossil fuel industry, the vast majority of which remained untouched in the tax bill. And while the majority of those subsidies favor the oil and gas industry, 20 percent go toward incentivizing coal consumption and production. What’s more, the effective tax rate for coal—which is less than 1 percent—stays the same. In other words, the government still sacrifices billions in revenue every year to prop up coal, an industry that most energy analysts agree is dying.

“The coal industry fares incredibly well [with the tax bill],” said Janet Redman, the U.S. policy director of Oil Change International. “None of the handouts that they get now are taken away. They chug ahead with every tax break they’ve enjoyed last year, the year before, and some that have been in the books for decades. They’ve lost nothing.”

The coal industry does lose something, though it’s fairly small. The tax bill eliminates Section 199 of the U.S. tax code, which allows companies to deduct income attributable to domestic production activities. That means there will be no more so-called “domestic manufacturing deduction for mining,” which allows mining companies to claim a tax break intended for the manufacturing of goods. That subsidy cost the government about $45 million last year, according to the group’s most recent report on fossil fuel subsidies.

“Despite rhetoric about a supposed war on coal, federal and state governments spent on average more than $4 billion annually incentivizing coal production in 2015 and 2016,” that report reads. The incentives preserved in the tax package include a nearly $1 billion annual subsidy for coal leasing in Wyoming’s Powder River Basin, which accounts for nearly 40 percent of the country’s coal production, and $100 million annually for the production of so-called “clean coal,” which does not exist. A combined $730 million in annual expenditures to cover shortfalls in coal miners’ pensions and black lung disability coverage. “This support for workers is critical,” Oil Change’s report reads, “but industry should pay for it.”

Given President Donald Trump’s obsession with reviving the dying industry, it’s almost surprising that the Republican tax bill doesn’t contain any new breaks or incentives that explicitly help coal. “Energy is actually the least of the beneficiaries in this bill, and the simple reason is that energy already has so many carve-outs and exemptions in the tax code that a lot of U.S. based companies just pay hardly any income tax as it is,” said Pavel Molchanov, an energy research analyst at the financial firm Raymond James. “So there is virtually no effect on energy of any kind, either positive or negative, and that includes coal.”

But when it comes to a dying industry like coal, the fact that the government is preserving billions in incentives to keep it on life support is a victory of sorts—especially when the alternative could have been a revenue raiser, like a carbon tax, that likely would have been the coal industry’s death knell. The coal industry should consider the tax bill a lucky break.