The Munich Reinsurance Company has been in the sober business of managed risk since 1880. Munich Re, as it is now known, helped pay for the devastation caused by the San Francisco earthquake in 1906, Hurricane Hugo in 1989, and the assault on the World Trade Center on September 11, 2001. The company, which in 2014 paid out approximately $45 billion in claims and netted $4 billion in profit, employs some 43,000 people—underwriters, economists, accountants, lawyers, and scientists—all working to predict and plan for the future, and with a shared mission: to make sure Munich Re is never surprised. Risk properly calculated makes money for Munich Re; risk unanticipated could bankrupt it.

These days, the greatest unpredictable risk Munich Re faces is climate change. Like other major insurers, Munich Re follows a standard procedure to ensure its premiums are set high enough to cover natural-catastrophe claims. Much of this work relies on what the company calls “event sets”—databases of past claims for a given type of loss in a given area. The company plots information from the event sets on a graph to form “loss-return curves,” which are used to make informed projections for the future. Assuming the curves are accurate—that future losses occur at a rate and intensity broadly consistent with past losses—all is well. Revenue from the premiums outpaces the costs of claims, corporate income rises, and investors bid up the stock. This is as it has ever been: Floods are few; insurance policies are many.

But insurance companies are starting to worry that climate change will upend the curves. Munich Re began studying global warming in 1974, when, in response to a global surge in natural catastrophes, it founded what it called the Joint Office for Natural Hazards. Known today as the Corporate Climate Center (CCI), the operation involves in-house geologists, geographers, hydrologists, and other scientists who research climate change and then model the ways it might affect the frequency and force of the natural disasters for which Munich Re sells surety.

Peter Hoeppe, a meteorologist, heads the CCI, and his group has concluded that, for the next few decades, climate change will remain fairly easy to predict and thus to insure. Beyond 2050, though, absent massive cuts in global greenhouse-gas emissions, “We may run into a situation where we have abrupt changes, and things become uninsurable,” Hoeppe told me. Abrupt changes is scientific euphemism for major disasters that Munich Re can’t foresee. That translates into premiums set too low to cover unexpected claims—and, more specifically, losses that could wipe out an alarming chunk of the company’s profits.

Large corporations always have been seen as the villains of the environmental movement—and with good reason. It was corporations whose cars coughed out smog, whose chemicals produced Superfund sites, and whose coal mining despoiled mountains. But today, in the fight against climate change, big business is emerging, if not quite as a hero, then as one of the world’s most important reformers. Politicians have so far failed to act with anything approaching the seriousness the scale of the problem requires. As governments dither, however, some of the world’s most potent multinationals have concluded that rising temperatures threaten their business. Thus they have begun to respond to global warming in the way they’d respond to any material financial threat: They’re looking to minimize it.

Many of the executives shouting about the perils of climate change from their corporate jets are little more than Madison Avenue marketers, ladling on cheap greenwash to obscure a financial structure that continues to profit mostly by polluting. That’s unsurprising and unlikely to change. What’s significant is that a widening web of corporate powerhouses—most notably in the finance industry, led by big insurers and banks—have begun to demand serious, sophisticated, and specific steps to counter global warming. Big businesses want nothing so much as predictability, and many of them have concluded that climate change is a wild card, one that they must control and ought to exploit.

Auto, oil, coal, agriculture, and other energy-intensive companies have been participating in the climate fight for years. But their intent has rarely extended beyond regulatory capture: The big burners have sought to be seen as reasonable on the issue because perceived reasonableness affords them a seat at the political table at which carbon-emission restrictions are written—with the cleanup burden, hopefully, shifted to someone else.

What’s happening now is different. Firms with comparatively small greenhouse-gas footprints, notably in the financial sector on which the global economy depends, have concluded their profitability is imperiled by climate change itself. It isn’t in their financial interest to minimize climate curbs; it’s to maximize them. Instead of regulatory capture, they want regulatory crackdown.

Study after study has concluded that private investment, if efficiently deployed, would outpace anything that governments could spend on climate change—and actually might meaningfully reduce the problem while preserving corporate profits. “This economic transition toward climate compatibility requires a redeployment of global investment the likes of which the world has never seen,” Achim Steiner, executive director of the United Nations Environment Program, said in a July speech in Luxembourg. “It’s not about public money,” added Connie Hedegaard, the European Commission’s former top climate official, at a forum in Sydney in August. “It’s about how you can spend public money in a way that leverages private investment.”

Insurance companies are the canaries in the coal mine of global finance: When noxious economic winds blow, they are the first to get sick. Global insurance industry losses from weather-related claims, according to Munich Re, jumped from an inflation-adjusted annual average of $10 billion during the 1980s to $50 billion in this decade. It is, of course, impossible to determine what percentage of that increase is due to climate change. But Munich Re’s Hoeppe called a surge of that magnitude “striking,” and he said the company is planning for a future in which climate change is at the very least a factor in increased claims. Other major insurers widely share this view.

Munich Re is both an insurer and a reinsurer. Insurers typically provide coverage to individuals and smaller firms; reinsurers provide it to multinational corporations, national governments, and other insurance companies. For both, climate change raises two fundamental concerns. The first stems from climate risks they believe they can project. Over time, if those risks expand, prudent insurers will be forced to raise premiums—potentially so high that customers won’t pay. “What we’re in business for declines if no one will buy our insurance. That’s the first problem we face,” Andrew Castaldi, senior vice president and head of catastrophe perils for the U.S. unit of Swiss Re, another major multinational reinsurer, told me.

The second major concern is about climate risks that insurance providers can’t account for—natural catastrophes of a severity or in a location their models are unable to project. For instance, Swiss Re’s models, like those of other reinsurers, probably underestimate the potential effect of climate-induced sea-level rise, Castaldi said. That’s because they rely on U.S. government models like Sea, Lake and Overland Surges from Hurricanes (SLOSH), which was developed by the National Weather Service and which Castaldi said isn’t sufficiently updated. When a major storm comes, he said, “we might see some significant differences that we’re not expecting.” Similarly, climate change might cause storms to make landfall in places different from the ones that the models anticipate. “With climate change we see just a little nudge in some of those variables—and they’re not your grandfather’s hurricanes anymore,” Castaldi said.

These aren’t just academic discussions; they are strategic financial ones. Large insurers have concluded climate change presents a material risk about which they have a fiduciary responsibility to warn investors. In its most recent annual report to the SEC, Travelers, the fifth-largest insurer in the United States, included a lengthy passage warning investors about the risks of climate change to its business:

Severe weather events over the last several years have underscored the unpredictability of future climate trends and created uncertainty regarding insurers’ exposures to financial loss as a result of catastrophes and other weather-related events. … Hurricane activity has impacted areas further inland than previously experienced by the Company, thus expanding the Company’s potential for losses from hurricanes. Additionally, both the frequency and severity of tornado and hail storms in the United States have been more volatile in recent years, while any further reductions in arctic sea ice may contribute to rising sea levels that could impact flooding in coastal areas. Accordingly, the Company may be subject to increased losses from catastrophes and other weather-related events. Additionally, the Company’s catastrophe models may be less reliable due to the increased unpredictability, frequency and severity of severe weather events or a delay in the recognition of recent changes in climate conditions.

Climate-related losses, the filing concluded, “could materially and adversely affect our results of operations, our financial position and/or liquidity, and could adversely impact our ratings, our ability to raise capital and the availability and cost of reinsurance.”

AXA, France’s largest insurer, paid out more than $1.1 billion in 2014 in claims for “weather-related insurance claims” —a category that includes natural catastrophes other than earthquakes, the sort of claims AXA considers linked to climate change. In 2015, for the first time, AXA began to publicly disclose percentages that correlate to the amount of insured assets that it believes are subject to climate risk. Of the $32.2 billion that AXA was required by European regulators to have on hand as of June 2015 to cover risks, roughly $1 billion was earmarked for natural catastrophe other than earthquakes. “Climate risk for us is neither an ideological or theoretical issue. It is a core business issue, as we are already seeing the impact of increasing weather-related disaster risks,” Henri de Castries, AXA’s CEO, said in a speech in May at a climate-finance conference sponsored by UNESCO.

One of the most serious climate risks is flooding, according to The Geneva Association, an insurance-industry research group, which suggested in a July report that climate change could massively drive up worldwide flood losses. New property, generated by economic growth and then destroyed, is expected to raise flood losses from the annual average of approximately $30 billion that prevailed between 2004 and 2013 to an average of about $52 billion in 2050, the group said. Adding climate change to the mix, it projected, will boost the expected annual loss in 2050 to $1 trillion or more. That’s an increase of a factor of 20.

Insurers are responding to the global-warming threat in two ways: By developing and selling novel kinds of insurance for clients who want to hedge their climate exposure; and by pressing policymakers in the United States and around the world to enact carbon-emission limits that are aggressive, detailed, and long-term. Those regulations would serve as a tool to minimize assets that could become uninsurable as temperatures change, and as a gauge to help insurers decide what degree of change they should factor into their future-loss models.

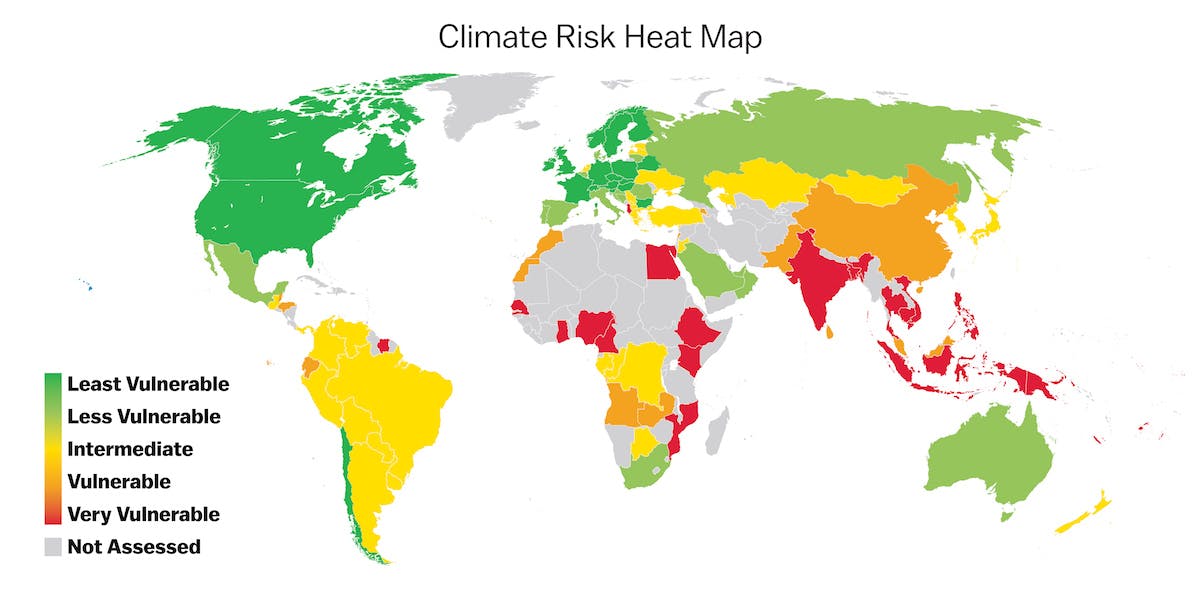

Developing countries are most likely to bear the brunt of damage from climate change, in part because they are located in vulnerable places and because their infrastructure is least prepared to withstand the threat. As a result, some of the first insurance adaptations have begun there. In June, at a summit in Germany, leaders of the G-7 countries declared a five-year goal of providing insurance “against the negative impact of climate-change-related hazards” to up to 400 million people in developing countries. Some of those countries already have created funding pools to bail out citizens in the event of natural disasters including floods and droughts. When a weather-related disaster occurs, these so-called parametric pools pay member governments predetermined amounts based on the measured intensity of the disaster: excess rainfall in a storm, lack of rainfall in a drought, or the magnitude of an earthquake, for instance. The African Risk Capacity, launched in 2012, includes 26 African countries and has about $200 million. The Caribbean Catastrophe Risk Insurance Facility, begun in 2007, covers 16 governments in the region and has roughly $130 million, including money from the governments and coverage from reinsurers. Reinsurers already have begun selling policies to those governments as a backstop for the public funds the governments have set aside.

Days after the G-7 summit, Nikolaus von Bomhard, Munich Re’s chairman, released a statement to the company’s shareholders detailing the profits a new insurance market for climate change risk could bring. The 400-million-person target, he wrote, shows “the size of the potential available to us if we succeed in developing a sustainable insurance model for them.” Swiss Re, too, has begun selling coverage to these insurance pools. “This is not a major line of business for us at the moment, but we think it’s one that’s going to grow as we move into developing countries,” said Mark Way, head of sustainability for Swiss Re’s U.S. subsidiary. AXA also has entered the market developing around the African Risk Pool.

Insurers have begun to sell insurance to the burgeoning renewable-energy and energy-efficiency industries. Munich Re established its own effort, which it calls Green Tech Solutions, in 2011. In the case of solar panels, manufacturers typically provide warranties guaranteeing that the panels won’t lose more than 20 percent of their power-producing capacity over 25 years. Munich Re sells policies that protect panel makers against excessive warranty claims and policies that protect solar panel buyers if a manufacturer fails and can’t honor a warranty claim. It has rolled out similar policies for wind turbines, fuel cells, and LED lights.

The Green Tech Solutions unit consists of 18 people, including economists, engineers, physicists, and one chemist, all based in New York, Hong Kong, Tokyo, and Munich. Since it was established four years ago, Munich Re has collected nearly $100 million in premiums from policies that originated from Green Tech, according to Michael Schrempp, who heads the unit. That’s about five-hundredths of 1 percent of the roughly $225 billion in total premiums that Munich Re sold during that period. Yet it’s significant to the company. Unlike Munich Re’s established insurance lines, which have been relatively flat, renewable-energy insurance, despite its small base, is growing fast. Schrempp declined to divulge the annual growth rate but called it “really exponential.”

Swiss Re is growing its climate insurance business by taking advantage of an inherent weakness of wind and solar energy: The wind doesn’t always blow, and the sun doesn’t always shine. Swiss Re’s weather models project the strength and timing of wind and sunlight over the course of a year, which the company then uses to anticipate the amount of money a renewable-energy producer should be able to make selling power. Then it sells the producer a policy protecting against what it calls the “revenue risk” resulting from renewable energy’s intermittency: unexpected dips in wind and sunlight and consequent reductions in sales. Swiss Re is enthusiastic about the prospects for what Way called this “cutting-edge” form of climate-induced insurance. “I personally was involved in a conversation around that with a potential client a week ago,” Way said.

In the lead-up to the Paris conference, insurers have been pushing for tougher and clearer global policies. “We would like to see ambitious and globally binding emission-reduction targets for the long term, so that we can plan for this,” Munich Re’s Hoeppe told me, a sentiment that other insurers repeat almost word for word. “A target means an investment,” he explained. One major goal is to get governments to honor a commitment they made at a 2009 climate conference in Copenhagen to deliver $100 billion a year to carbon-cutting projects in the developing world. That pledge has broken down in bickering over how much each country should have to pay. Swiss Re wants the diplomats in Paris to earmark some of that money to install more stations in developing countries to collect weather data—data that insurance companies could use to build better models to sell more policies in those places. Government, Swiss Re’s Way said, could “put the pieces in place that would help allow insurance to grow in areas where it’s not been in existence,” seeding the market for big insurers.

Like insurers, the world’s largest banks and institutional investors are both scared and salivating at how climate change is affecting their businesses. In news releases, many of them like to talk up minor advances like their installations of solar panels and energy-efficient light bulbs in their bank branches. But that’s just public relations. The meaningful step financiers have taken is to start shifting some of the trillions of dollars they control from higher-carbon to lower-carbon investments. They’re also lobbying governments for regulations that would make it more profitable for them to move a bigger tranche of their money in that green direction.

Some 200 universities, religious groups, and pension funds have announced over the past couple of years that they’ll divest, or sell off, some of their fossil-fuel holdings. The biggest move came in June, when Norway’s parliament voted to order the country’s public pension fund—the world’s largest sovereign-wealth fund, with about $850 billion under management—to shed its holdings next year in companies that derive 30 percent or more of their revenue from coal. These divestment decisions, however, are akin to bank-branch light bulbs: They’re more symbolic than substantive. In most divestment deals, the fine print typically limits the sell-off to a relatively tiny percentage of the portfolio. A September study by Norges Bank, which manages Norway’s sovereign fund, estimated that the country’s anti-coal vote could result in a divestment of $6.7 billion—that is, less than 1 percent of the fund’s total assets. Norway owes much of its national wealth to sales of oil and gas, fossil fuels it has in abundance.

Yet divestment is merely a small part of a potentially massive restructuring of the financial sector. Organizations representing tens of trillions of dollars in institutional wealth have begun calling for tougher climate action in the belief that it could boost profits. In May, the Institutional Investors Group on Climate Change, a coalition of pension funds, private money managers, university endowments, foundations, and other large investors collectively controlling more than $12 trillion, wrote a letter to the finance ministers of the G-7, calling climate change “one of the biggest systemic risks we face,” and demanding an “ambitious agreement in Paris.” The letter, whose signatories included the heads of BNP Paribas Investment Partners, Harvard University’s endowment, and the massive public-employee retirement funds of California and New York, added: “With the right market signals from policymakers, investment in low-carbon and climate resilient opportunities can flow and climate impacts and resulting economic damages can be mitigated.”

An even more striking moment came this past spring, when the G-20 major economies asked the Financial Stability Board, a Swiss-based body that makes recommendations about the global financial system, to assess the risks global warming poses to the world economy. In a stern speech in late September at Lloyd’s of London, Mark Carney, the financial board’s chairman and governor of the Bank of England, cited estimates that predicted that preventing the average global temperature from surpassing a 2-degree Celsius increase over preindustrial temperatures—a key measure—could require leaving as much as two-thirds of the world’s proven fossil-fuel reserves in the ground. Carney warned of a potentially devastating hit to the global economy if, as a result, investors shed fossil-fuel-dependent assets en masse. “Capital should be allocated to reflect fundamentals, including externalities,” he declared, one of those “fundamentals” being the “externality” of climate change, which investors traditionally haven’t considered in assessing a company’s financial prospects. Such a devaluation could potentially “destabilize markets, spark a pro-cyclical crystallization of losses and a persistent tightening of financial conditions,” he said. Translation: The head of two of global finance’s most important institutions warned that if companies don’t do something serious to manage their carbon risk—including pressing governments for tougher climate policies—investors may dump their stocks, potentially triggering a debilitating downward economic spiral.

Carney called climate change the “tragedy on the horizon”—a longer-term problem executives and policymakers fail to address because they view its dangers as outside of their planning time frames. He called for climate-risk disclosure practices similar to the financial-risk disclosure standards that emerged from the global financial crisis. “Companies would disclose not only what they are emitting today,” he said, “but how they plan their transition to the net-zero world of the future.”

Many multinationals have begun to disclose climate-related information. But because no mandatory single standard exists, what is disclosed varies greatly from company to company, making what is revealed of little use to investors. That financial watchdogs are calling for stricter climate change disclosures shows the seriousness of what’s transpiring—and that the financial system is beginning to conclude that this information is material to their returns.

The Sustainability Accounting Standards Board (SASB), a U.S.-based nonprofit, has developed, in consultation with companies and with the SEC, new standards for companies to use to ensure that they are disclosing sufficient information in their financial filings about their material climate risks. Energy use in bank buildings does not “meet the threshold of materiality,” an SASB briefing paper noted. What banks should instead disclose is the financing they provide to “industries that have substantial impacts on the environment.” The performance of loans to companies that are responsible for large amounts of greenhouse gases, SASB warned, “could be substantially impacted by certain scenarios of regulatory responses to climate change.” These calls for disclosure are yielding results. The Portfolio Decarbonization Coalition is a group of institutional investors that formed at a 2014 United Nations climate-finance summit. It is currently on track to amass by the end of the year commitments from large enterprises to reduce the carbon intensity of $100 billion worth of investments, according to a U.N. report in October. The coalition is part of a broader corporate campaign that has pledged to measure and disclose the carbon intensity of more than $3 trillion in assets.

Disclosure, however, is just a means to an end: predictability. The financial sector is pressing governments to enact climate policies that grow tougher at a foreseeable rate over time. Carney, the Financial Stability Board chairman, said in his September speech that such clarity from policymakers would “link climate exposures to a monetary value and provide a perspective on the potential impacts of future policy changes on asset values and business models.” It would, in other words, reset the global economy, giving the market the certainty to shift toward a lower-carbon path.

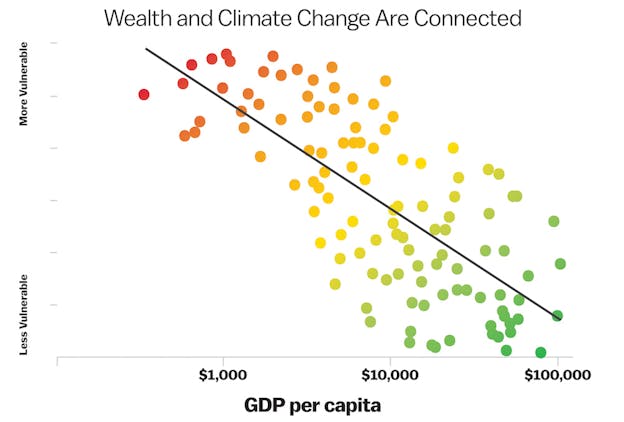

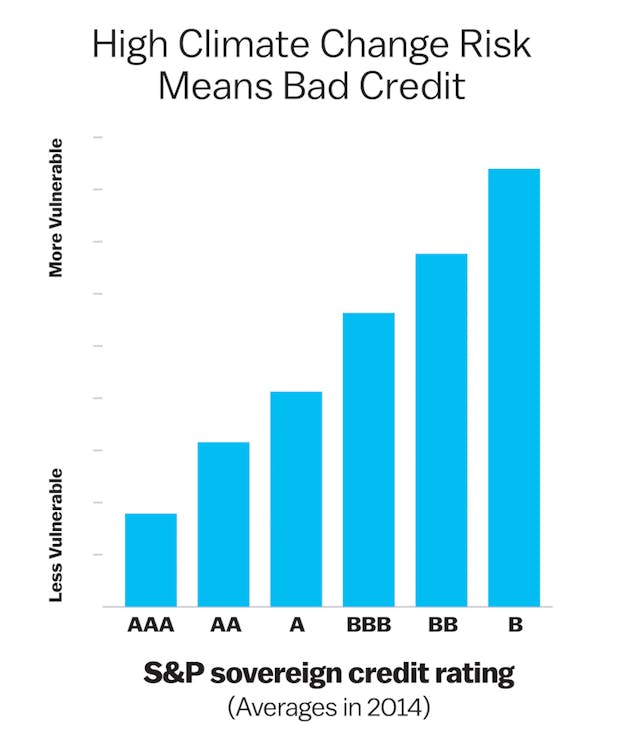

Standard & Poor’s, the credit-rating agency, has been even blunter in pushing policymakers to act. In a research report published in May 2014, it raised the possibility that it might, for the first time in its history, begin downgrading the creditworthiness of governments it deems particularly vulnerable to climate-related extreme weather events. It called climate change and aging the two “global megatrends” that it believes will most hit countries’ balance sheets throughout the rest of this century. “We expect the significance of this megatrend … to only increase over coming decades as evidence of the economic implications of climate change and extreme weather events becomes ever more visible.” S&P ranked by climate risk the credit of the 116 governments it rates: Low-lying developing countries fared worst, with Cambodia, which had the highest risk, coming dead last. Rich countries in the North did best, with Luxembourg topping the list. The United States tied with Poland for tenth.

In recent months, financial institutions have issued research reports that amount to lobbying playbooks for Paris. Citigroup’s version, a 132-page study released in August, argues that investors are anxious to put money into renewable-energy and energy-efficiency projects but that outdated government rules are holding them back. To counteract that, and to spur investment, governments should “impose carbon prices which are high enough to level the playing field” with fossil fuels, and should also minimize fossil-fuel subsidies, which, particularly in developing countries, artificially reduce the price consumers pay for high-carbon energy. The International Energy Agency (IEA) estimated that, in 2013, global fossil-fuel subsidies totaled $548 billion. Shifting these subsidies to cleaner forms of energy, Citigroup wrote, “could have a transformational effect on the energy complex at relatively limited cost.”

Banks are also putting more money into investments designed to curb climate change. Citigroup, for example, announced that it will “lend, invest and facilitate” a total of $100 billion over the next decade for initiatives that curb climate change, from renewable-energy projects to public transportation to energy-efficient low-income housing. Much of that money won’t come from Citigroup itself but from other investors it brings to the table. Still, that’s double the amount of a similar financial pledge made by the bank in 2007. It’s also broadly in line with promises from other major banks. Bank of America announced in July that it will spend $125 billion on climate-related investments over the next decade. These sums remain minor in the context of the banks’ overall businesses. Yet if the trillions of dollars that institutional investors have pledged to shift into low-carbon investments are included, the private sector is now on track to spend more than governments on climate change.

Banks also are admonishing governments to spend public climate dollars in more strategic ways. In its August report, Citigroup argued that if rich countries delivered the $100 billion annually that they have promised to invest in developing nations, they should spend it not by investing directly in clean-energy projects, the traditional strategy, but by providing a financial backstop that would foster much larger amounts of private loans. Virtually all the growth in future global energy demand will come from developing countries, yet these countries typically have unfavorable debt ratings, which means they pay high interest rates when they borrow money. The $100 billion, “if used for credit enhancement rather than by investing directly,” Citigroup wrote, “might ultimately facilitate much greater levels of investment.” An auxiliary benefit for Citigroup: It would increase its loan business.

Loans for carbon-cutting activities are booming. The market for “green bonds,” debt that bankrolls climate-friendly projects and is bought by companies with balance sheets large enough to persuade financiers to lend at attractive interest rates, jumped from practically zero three years ago to $37 billion in 2014, and it’s expected to reach between $50 billion and $70 billion by the end of 2015, according to the United Nations. That’s a tiny slice of the roughly $80 trillion total global bond market, but its rapid growth has investors piling on. Toyota, for example, raised $1.75 billion in 2014 in green bonds that the auto maker used to finance consumer purchases of its hybrid cars. It completed a second such deal in 2015, raising an additional $1.25 billion. Lenders, like Bank of America and Barclays, have begun selling green-bond index funds, a way for ordinary investors to enter the market.

In 1987, Gordon Gekko, the villainous finance titan from Oliver Stone’s film Wall Street, addressed shareholders from a company he was about to take over. “Greed,” he intoned, “is good.” Whether the profit motive will be enough to stop climate change is far from certain. In 2013, renewable-energy investment was $250 billion, up dramatically from a decade earlier, but still only 16 percent of the $1.6 trillion that was invested in all energy-supply worldwide, according to the IEA. The finance industry continues to spend more on high-carbon than low-carbon investments. What is clear, however, is that the finance sector is moving with mounting speed and sophistication to reckon with a risk it is coming to regard as existential. Profiteers, in other words, are emerging as potent leaders on climate change, and it is of no concern to the planet—indeed, it is a benefit—that their motives are mercenary. The question now is whether politicians will follow them.