In March, E-Trade, the financial services company that offers Americans low rates to personally trade stocks, launched a new advertisement (which has run both on TV and the web) with horrific investment advice.

The 30-second commercial shows a bearded man walking through the streets with his wife, who begins to notice that all other passing men have facial hair too. “You, my friend, have recognized when a trend has reached critical mass,” says a coffee-holding Kevin Spacey, appearing out of nowhere. “Yes, when others focus on one thing, you see what’s coming next. You see opportunity. That’s what a Type-E does.” Suddenly, the wife notices a clean-shaven man exiting a barbershop. Clearly, the ad insinuates, beards are going out of style—and she’s the first to notice.

“With E-Trade’s investing insights center, you can spot trends before they become trendy,” a voiceover says. Don’t do this. The average American is terrible at picking stocks. It’s almost impossible to spot trends before they become trendy—unless you have a huge industry research department, like the banks and hedge funds on the other side of these trades. And even then, they generally are terrible at picking stocks.

Instead, you should invest your money in a low-fee mutual fund. If you really want to purchase stocks yourself, create a diversified portfolio and if you can, don’t touch it. The stock market generally goes up over time, so such a portfolio will slowly grow. But don’t bet on individual stocks.

Economics reporters like Matt Yglesias and Megan McArdle have long been preaching this advice. And in the post-financial crisis world, it has actually begun to take: The housing bubble and Great Recession sent American confidence in active investing plummeting. In response, investors—from fund management professionals to individual workers with 401(k)s—have switched their savings from funds that are actively managed to ones that are passively managed, which means the funds are simply invested in a diversified portfolio and not actively traded.

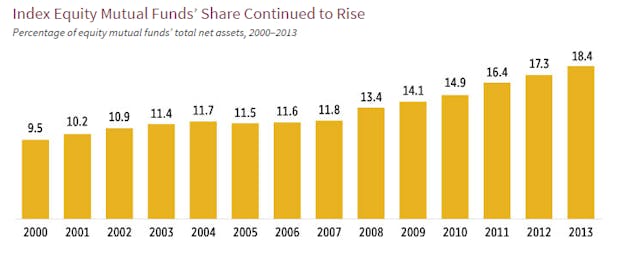

You can see this change in the 2014 Investment Company Fact Book, which is published by the Investment Company Institute, a trade group. The percentage of mutual funds’ net assets that are in index funds was about constant from 2003-2007 but has risen each year since then, reaching 18.4 percent in 2014. (An index equity mutual fund is a form of passive investing that invests in a fund intended to track a market index like the S&P 500). This is one of the biggest trends in the financial industry over the past few years.

Whether it will continue is unclear. As we move further away from the crisis and as the economy continues to rebound, investors will likely begin searching for new ways to increase their returns. Active investing will again become more appealing.

But you should resist that urge. There will eventually be another crisis, and many of those active investors will take huge losses. If you invest in a low-fee mutual fund, you probably won’t exit unscathed—but you won’t see your savings wiped out either. Over time, odds are, you’ll eventually come out ahead.